Ever dreamed of owning an RV but worried about the costs? Here’s what you need to know about financing your RV! Understanding the ins and outs of RV financing can make the process smoother and more affordable.

1. Assess Your Budget

Start by taking a close look at your finances. Understand your income, expenses, and any existing debts. This will give you a clear picture of what you can afford.

Set a realistic budget for your RV purchase. Include the cost of the RV, insurance, maintenance, and other related expenses. Knowing your budget helps you avoid financial stress and ensures you make a smart investment.

2. Research Loan Options

Look into the different loan options available for financing your RV. You can choose between personal loans and RV-specific loans. Each has its own benefits.

Personal loans might offer more flexibility, but RV-specific loans often come with better terms for this type of purchase. Compare the interest rates, terms, and conditions of each option. Finding the right loan can save you money and make the buying process smoother.

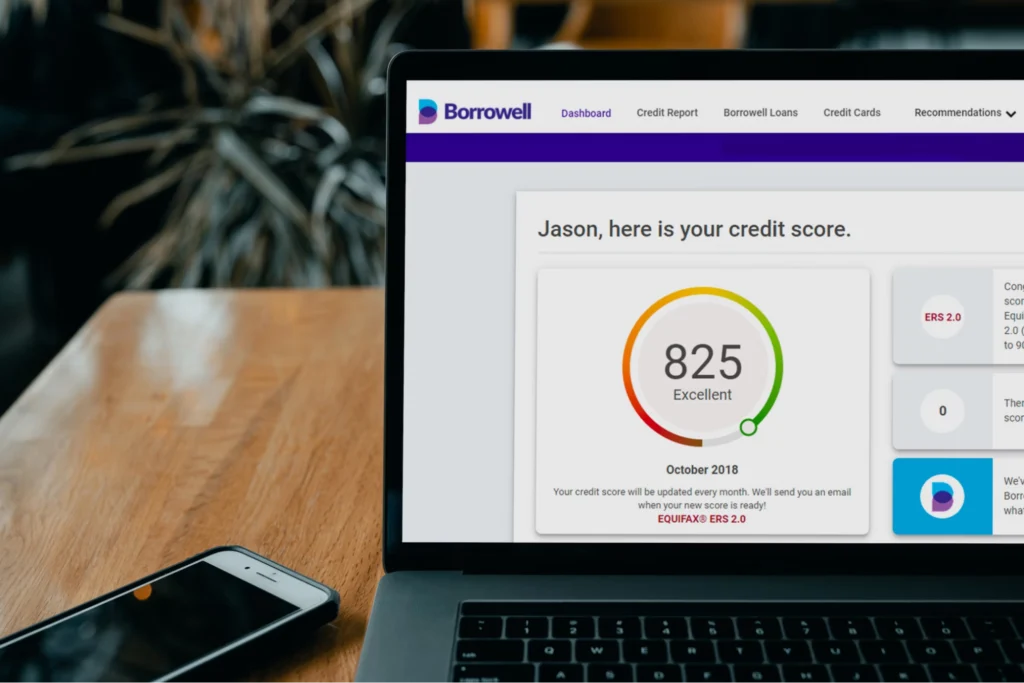

3. Check Your Credit Score

Your credit score has a big impact on your loan approval and the interest rate you’ll receive. A higher credit score can help you get a lower interest rate, which saves you money over the life of the loan.

Before applying, check your credit report for any errors and work on improving your score if needed. Paying down debt and making timely payments can boost your credit score. Knowing your credit standing helps you understand what loan options are available to you.

4. Down Payment: How Much Should You Put Down?

A typical down payment for an RV ranges from 10% to 20% of the purchase price. Putting down more money upfront can reduce your monthly payments and lower the overall cost of the loan.

A larger down payment also shows lenders that you’re committed, which might help you get better loan terms.

Consider your savings and budget to determine how much you can comfortably put down. Making a significant down payment can set you up for more manageable payments in the future.

5. Interest Rates and Loan Terms

Understanding interest rates and loan terms is essential when financing your RV. Interest rates can vary based on your credit score, loan amount, and the lender. Typically, the better your credit score, the lower your interest rate.

Loan terms for RV financing usually range from 5 to 20 years. Longer terms mean lower monthly payments but more interest paid over time.

Compare offers from different lenders to find the best rate and terms that fit your financial situation. Knowing your options helps you make an informed decision and save money in the long run.

6. Calculate Total Costs

When budgeting for your RV, it’s important to consider all related expenses. This includes not just the loan payments but also taxes, registration, and insurance costs. These additional expenses can add up quickly and impact your overall budget.

Use an RV loan calculator to estimate your monthly payments and total loan cost. Factor in maintenance, fuel, and potential campground fees as well. Having a clear understanding of all costs helps you avoid surprises and ensures you’re financially prepared for RV ownership.

7. Pre-Approval: Why It’s Beneficial

Getting pre-approved for an RV loan offers several advantages. First, it gives you a clear idea of your budget, so you know exactly how much you can afford. This helps you shop confidently without overspending.

Pre-approval also strengthens your negotiating position with dealers. They know you’re a serious buyer, which can sometimes lead to better deals. Additionally, having a pre-approved loan speeds up the buying process, making it smoother and less stressful.

Overall, pre-approval provides peace of mind and makes your RV purchase more straightforward. It’s a smart step to take before you start shopping.

8. Dealer Financing vs Bank Loans

When financing your RV, you have two main options: dealer financing and bank loans. Dealer financing can be convenient and may offer special promotions or incentives. It’s often easier to arrange financing directly through the dealership when you’re buying your RV.

However, bank loans often come with lower interest rates and better terms. Banks and credit unions can offer more competitive rates because they aren’t tied to the sale of the RV.

Comparing both options is crucial. While dealer financing might be convenient, a bank loan could save you money over the life of the loan. Take the time to explore both and choose the one that best fits your needs.

9. Hidden Fees and Costs to Watch Out For

Be aware of potential hidden fees when financing your RV. Loan origination fees, prepayment penalties, and administrative costs can add up quickly. Always ask your lender for a full breakdown of all fees involved.

Extended warranties and add-ons are often offered by dealers. While they can be beneficial, they also come at an extra cost. Evaluate these options carefully to decide if they’re worth the additional expense.

Other hidden costs include taxes, registration, and insurance premiums. These can significantly impact your budget, so make sure you factor them in when calculating your total costs. Knowing about these fees upfront helps you avoid surprises and manage your finances better.

10. Refinancing Your RV Loan

Refinancing your RV loan can be a smart financial move under the right circumstances. If interest rates drop or your credit score improves, refinancing can lower your monthly payments and reduce the overall cost of your loan.

Review your current loan terms and compare them with new offers. Look for lower interest rates and better terms that can save you money.

Be aware of any fees associated with refinancing, such as loan origination or prepayment penalties. Calculating the potential savings versus these costs will help you determine if refinancing is beneficial. Refinancing can provide significant financial relief and make your RV ownership more affordable.

11. Final Tips for Financing Your RV

Do thorough research and compare offers from multiple lenders. This helps you find the best interest rates and terms. Don’t rush into a decision; taking your time ensures you make the best financial choice.

Consider consulting with a financial advisor. They can provide personalized advice based on your financial situation and help you understand all your options.

Look for discounts and deals. Some lenders offer incentives for automatic payments or bundling services. Every bit of savings helps when managing a significant investment like an RV.

Read the fine print carefully. Understand all terms, conditions, and fees associated with your loan. Being informed prevents unexpected surprises down the road.

Conclusion

Financing your dream RV doesn’t have to be daunting. With the right knowledge and preparation, you can make informed decisions and secure a loan that fits your budget. Enjoy the freedom and adventure of RV ownership without breaking the bank! Share your experiences and tips in the comments below. Safe travels!